IT’S STILL YOUNG LOVE

IT’S STILL YOUNG LOVE

Anthony Hurd, 2023

More Posts from Sentimentalrobots and Others

October 6, 1998 an ordinary boy was beaten and left for dead, tied to a fence in a pasture in Wyoming. The people who came upon the body believed it was not human but a scarecrow but for the only part of his face not covered in blood were two white lines running down his cheeks where the tears had dried. His death was horrific yet not in vain. This ordinary boy set in motion a fight for equality, a fight for dignity. You don't have to be gay to understand this, you need only be human. Say his name…. Matthew Shepard

How unions won a 30% raise for every fast food worker in California

Tonight (September 14), I'm hosting the EFF Awards in San Francisco. On September 22, I'm (virtually) presenting at the DIG Festival in Modena, Italy.

Anything that can't go on forever will eventually stop. 40 years of declining worker power shattered the American Dream (TM), producing multiple generations whose children fared worse than their parents, cratering faith in institutions and hope for a better future.

The American neoliberal malaise – celebrated in by "centrists" who insisted that everything was fine and nothing could be changed – didn't just lead to a sense of helplessness, but also hopelessness. Denialism and nihilism are Siamese twins, and the YOLO approach to the climate emergency, covid mitigation, the housing crisis and other pressing issues can't be disentangled from the Thatcherite maxim that "There is NoA lternative." If there's no alternative, then we're doomed. Dig a hole, climb inside, pull the dirt down on top of yourself.

But anything that can't go on forever will eventually stop. For decades, leftists have taken a back seat to liberals in the progressive coalition, allowing "unionize!" to be drowned out by "learn to code!" The liberal-led coalition ceded the mantle of radical change to fake populist demagogues on the right.

This opened a space for a mirror-world politics that insisted that "conservatives" were the true defenders of women (because they were transphobes), of bodily autonomy (because they were vaccine deniers), of the environment (because they opposed wind-farms) and of workers (because they opposed immigration):

https://pluralistic.net/2023/09/05/not-that-naomi/#if-the-naomi-be-klein-youre-doing-just-fine

Anything that can't go on forever will eventually stop. A new coalition dedicated to fighting corporate power has emerged, tackling capitalism's monopoly power, and the corruption and abuse of workers it enables. That coalition is global, it's growing, and it's kicking ass.

Case in point: California just passed a law that will give every fast-food worker in the state a 30% raise. This law represents a profound improvement to the lives of the state's poorest workers – workers who spend long hours feeding their neighbors, but often can't afford to feed themselves at the end of a shift.

But just as remarkable as the substance of this new law is the path it took – a path that runs through a new sensibility, a new vibe, that is more powerful than mere political or legal procedure. The story is masterfully told in The American Prospect by veteran labor writer Harold Meyerson:

https://prospect.org/labor/2023-09-13-half-million-california-workers-get-raise/

The story starts with Governor Newsom signing a bill to create a new statewide labor-business board to mediate between workers and bosses, with the goal of elevating the working conditions of the state's large, minimum-wage workforce. The passage of this law triggered howls of outrage from the state's fast-food industry, who pledged to spend $200m to put forward a ballot initiative to permanently kill the labor-business board.

This is a familiar story. In 2019, California's state legislature passed AB-5, a bill designed to end the gig-work fiction that people whose boss is an algorithm are actually "independent businesses," rather than employees. AB5 wasn't perfect – it swept up all kinds of genuine freelancers, like writers who contributed articles to many publications – but the response wasn't aimed at fixing the bad parts. It was designed to destroy the good parts.

After AB-5, Uber and Lyft poured more than $200m into Prop 22, a ballot initiative designed to permanently bar the California legislature from passing any law to protect "gig workers." Prop 22's corporate backers flooded the state with disinformation, and procured a victory in 2020. The aftermath was swift and vicious, with Prop 22 used as cover in mass-firings of unionized workers across the state's workforce:

https://pluralistic.net/2021/01/05/manorialism-feudalism-cycle/#prop22

Workers and the politicians who defend them were supposed to be crushed by Prop 22. Its message was "there is no alternative." "Abandon hope all ye who enter here." "Resistance is futile." Prop 22 was worth spending $200m on because it wouldn't just win this fight – it would win all fights, forever.

But that's not what happened. When the fast-food barons announced that they were going to pump another $200m into a state ballot initiative to kill fair wages for food service workers, they got a hell of a surprise. SEIU – a union that has long struggled to organize fast-food workers – collaborated with progressive legislators to introduce a pair of new, even further-reaching bills.

One bill would have made the corporate overseers of franchise businesses jointly liable for lawbreaking by franchisees – so if a McDonald's restaurant owner stole their employees' wages, McDonalds corporate would also be on the hook for the offense. The second bill would restore funding and power to the state Industrial Welfare Commission, which once routinely intervened to set wages and working standards in many state industries:

https://www.gtlaw-laborandemployment.com/2023/08/the-california-iwc-whats-old-is-new-again/

Fast-food bosses fucked around, and boy did they find out. Funding for the IWC passed the state budget, and the franchisee joint liability is set to pass the legislature this week. The fast-food bosses cried uncle and begged Newsom's office for a deal. In exchange for defunding the IWC and canceling the vote on the liability bill, the industry has agreed to an hourly wage increase for the state's 550,000 fast-food workers, from $15.50 to $20, taking effect in April.

The deal also includes annual raises of either 3.5% or the real rise in cost of living. It keeps the labor-management council that the original bill created (the referendum on killing that council has been cancelled). The council will include two franchisees, two fast food corporate reps, two union reps, two front-line fast-food workers and a member of the public. It will have the power to direct the state Department of Labor to directly regulate working conditions in fast-food restaurants, from health and safety to workplace violence.

It's been nearly a century since business/government/labor boards like this were commonplace. The revival is a step on the way to bringing back the practice of sectoral bargaining, where workers set contracts for all employers in an industry. Sectoral bargaining was largely abolished through the dismantling of the New Deal, though elements of it remain. Entertainment industry unions are called "guilds" because they bargain with all the employers in their sector – which is why all of the Hollywood studios are being struck by SAG-AFTRA and the WGA.

So what changed between 2020 – when rideshare bosses destroyed democratic protections for workers by flooding the zone with disinformation to pass Prop 22 – and 2023, when the fast food bosses folded like a cheap suit? It wasn't changes to the laws governing ballot initiatives, nor was it a lack of ready capital for demolishing worker rights. Fast food executives weren't visited by three ghosts in the night who convinced them to care for their workers. Their hearts didn't grow by three sizes.

What changed was the vibe. The Hot Labor Summer was a rager, and it's not showing any signs of slowing. Obviously that's true in California, where nurses and hotel workers are also striking, and where strikebreaking companies like Instawork ("Uber for #scabs") attract swift regulatory sanction, rather than demoralized capitulation:

https://pluralistic.net/2023/07/30/computer-says-scab/#instawork

The hot labor summer wasn't a season – it was a turning point. Everyone's forming unions. Think of Equity Strip NoHo, the first strippers' union in a generation, which won recognition from their scumbag bosses at North Hollywood's Star Garden Club, who used every dirty trick to kill workplace democracy.

The story of the Equity Strippers is amazing. Two organizers, Charlie and Lilith, appeared on Adam Conover's Factually podcast to describe the incredible creativity and solidarity they used to win recognition, and the continuing struggle to get a contract out of their bosses, who are still fucking around and assuming they will not find out:

https://www.youtube.com/watch?v=_fgXihmHIZk

Like the fast-food bosses, the Star Garden's owners are in for a surprise. One of the most powerful elements of the Equity Strippers' story is the solidarity of their customers. Star Garden's owners assumed that their clientele were indiscriminate, horny assholes who didn't care about the wellbeing of the workers they patronized, and would therefore cross a picket-line because parts is parts.

Instead, the bar's clientele sided with the workers. People everywhere are siding with workers. A decade ago, when video game actors voted on a strike, the tech workers who coded the games were incredibly hostile to them. "Why should you get residuals for your contribution to this game when we don't?"

But SAG-AFTRA members who provide voice acting for games just overwhelmingly voted to authorize a strike, and this time the story is very different. This time, tech workers are ride-or-die for their comrades in the sound booths:

https://www.latimes.com/entertainment-arts/business/story/2023-09-13/video-game-voice-actor-sag-strike-interactive-agreement-actors-strike

What explains the change in tech workers' animal sentiments? Well, on the one hand, labor rights are in the air. The decades of cartoonish, lazy dismissals of labor struggles have ended. And on the other hand, tech workers have been proletarianized, with 260,000 layoffs in the sector, including 12,000 layoffs at Google that came immediately after a stock buyback that would have paid those 12,000 salaries for the next 27 years:

https://doctorow.medium.com/the-proletarianization-of-tech-workers-ad0a6b09f7e6

Larry Lessig once laid out a theory of change that holds that our society is governed by four forces: law (what's legal), norms (what's socially acceptable), markets (what's profitable) and code (what's technologically possible):

https://cs.stanford.edu/people/eroberts/cs181/projects/2010-11/CodeAndRegulation/about.html

These four forces interact. When queer relationships were normalized, it made it easier to legalize them, too – and then the businesses that marriage equality became both a force for more normalization and legal defense.

When Lessig formulated this argument, much of the focus was on technology – how file-sharing changed norms, which changed law. But as the decades passed, I've come to appreciate what the argument says about norms, the conversations we have with one another.

Neoliberalism wants you to think that you're an individual, not a member of a polity. Neoliberalism wants you to bargain with your boss as a "free agent," not a union member. It wants you to address the climate emergency by recycling more carefully – not by demanding laws banning single-use plastics. It wants you to fight monopolies by shopping harder – not by busting trusts.

But that's not what we're doing – not anymore. We're forming unions. We're demanding a Green New Deal. And we're busting some trusts. The DoJ Antitrust Division case against Google is the (first) trial of the century, reviving the ancient and noble practice of fighting monopolies with courts, not empty platitudes.

The trial is incredible, and Yosef Weitzman's reporting on Big Tech On Trial is required reading. I'm following it closely (thankfully, there's a fulltext RSS feed):

https://www.bigtechontrial.com/p/what-makes-google-great

The neoliberal project of instilling learned helplessness about corporate power has hit the wall, and it's wrecked. The same norms that made us furious enough to put Google on trial are the norms that made us angry – not cynical – about Clarence Thomas's bribery scandals:

https://pluralistic.net/2023/04/06/clarence-thomas/#harlan-crow

And they're the same norms that made us support our striking comrades, from hotel housekeepers to Hollywood actors, from strippers to Starbucks baristas:

https://thetyee.ca/News/2023/09/13/Starbucks-Workers-Back-At-Strike/

Yes, Starbucks baristas. The Starbucks unions that won hard-fought recognition drives are now fighting the next phase of corporate fuckery: Starbucks corporate's refusal to bargain for a contract. Starbucks is betting that if they just stall long enough, the workers who support the union will move on and they'll be able to go back to abusing their workers without worrying about a union.

They're fucking around, and they're finding out. Starbucks workers at two shops in British Columbia – Clayton Crossing in Surrey and Valley Centre in Langley – have authorized strikes with a 91% majority:

https://thetyee.ca/News/2023/09/13/Starbucks-Workers-Back-At-Strike/

Where did the guts to do this come from? Not from labor law, which remains disgustingly hostile to workers (though that's changing, as we'll see below). It came from norms. It came from getting pissed off and talking about it. Shouting about it. Arguing about it.

Laws, markets and code matter, but they're nothing without norms. That's why Uber and Lyft were willing to spend $200m to fight fair labor practices. They didn't just want to keep their costs low – they wanted to snuff out the vibe, the idea that workers deserve a fair deal.

They failed. The idea didn't die. It thrived. It merged with the idea that corporations and the wealthy corrupt our society. It was joined by the idea that monopolies harm us all. They're losing. We're winning.

The BC Starbucks workers secured 91% majorities in their strike votes. This is what worker power looks like. As Jane McAlevey writes in her Collective Bargain, these supermajorities – ultramajorities – are how we win.

https://doctorow.medium.com/a-collective-bargain-a48925f944fe

The neoliberal wing of the Democratic party hires high-priced consultants who advise them to seek 50.1% margins of victory – and then insist that nothing can be done because we live in the Manchin-Synematic Universe, where razor-thin majorities mean that there is no alternative. Labor organizers fight for 91% majorities – in the face of bosses' gerrymandering, disinformation and voter suppression – and get shit done.

Shifting the norms – having the conversations – is the tactic, but getting shit done is the goal. The Biden administration – a decidedly mixed bag – has some incredible, technically skilled, principled fighters who know how to get shit done. Take Lina Khan, who revived the long-dormant Section 5 of the Federal Trade Act, which gives her broad powers to ban "unfair and deceptive" practices:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

Khan's wielding this broad power in all kinds of exciting ways. For example, she's seeking a ban on noncompetes, a form of bondage that shackles workers to shitty bosses by making it illegal to work for anyone else in the same industry:

https://pluralistic.net/2022/02/02/its-the-economy-stupid/#neofeudal

Noncompete apologists argue that these merely protect employers' investment in training and willingness to share sensitive trade secrets with employees. But the majority of noncompetes are applied to fast food workers – yes, the same workers who just won a 30%, across-the-board raise – in order to prevent Burger King cashiers from seeking $0.25/hour more at a local Wendy's.

Meanwhile, the most trade-secret intensive, high-training industry in the world – tech – has no noncompetes. That's not because tech bosses are good eggs who want to do right by their employees – it's because noncompetes are banned in California, where tech is headquartered.

But in other states, where noncompetes are still allowed, bosses have figured out how to use them as a slippery slope to a form of bondage that beggars the imagination. I'm speaking of the Training Repayment Agreement Provision (AKA, the TRAP), a contractual term that forces workers who quit or get fired to pay their ex-bosses tens of thousands of dollars, supposedly to recoup the cost of training them:

https://pluralistic.net/2022/08/04/its-a-trap/#a-little-on-the-nose

Now, TRAPs aren't just evil, they're also bullshit. Bosses show pet-groomers or cannabis budtenders a few videos, throw them a three-ring binder, and declare that they've received a five-figure education that they must repay if they part ways with their employers. This gives bosses broad latitude to abuse their workers and even order them to break the law, on penalty of massive fines for quitting.

If this sounds like an Unfair Labor Practice to you, you're not alone. NLRB General Counsel Jennifer Abruzzo agrees with you. She's another one of those Biden appointees with a principled commitment to making life better for American workers, and the technical chops to turn that principle into muscular action.

In a case against Juvly Aesthetics – an Ohio-based chain of "alternative medicine" and "aesthetic services" – Abruzzo argues that noncompetes and TRAPs are Unfair Labor Practices that violate the National Labor Relations Act and cannot be enforced:

https://www.nlrb.gov/case/09-CA-300239

Two ex-Juvly employees have been hit with $50-60k "repayment" bills for quitting – one after refusing to violate Ohio law by performing "microneedling," another for quitting after having their wages stolen and then refusing to sign an "exit agreement":

https://prospect.org/labor/2023-09-14-nlrb-complaint-calls-noncompete-agreement-unfair-labor-practice/

If the NLRB wins, the noncompete and TRAP clauses in the workers' contracts will be voided, and the workers will get fees, missed wages, and other penalties. More to the point, the case will set the precedent that noncompetes are generally unenforceable nationwide, delivering labor protection to every worker in every sector in America.

Abruzzo has been killing it lately: just a couple weeks ago, she set a precedent that any boss that breaks labor law during a union drive automatically loses, with instant recognition for the union as a penalty (rather than a small fine, as was customary):

https://pluralistic.net/2023/09/06/goons-ginks-and-company-finks/#if-blood-be-the-price-of-your-cursed-wealth

Abruzzo is amazing – as are her colleagues at the NLRB, FTC, DOJ, and other agencies. But the law they're making is downstream of the norms we set. From the California lawmakers who responded to fast food industry threats by introducing more regulations to the strip-bar patrons who refused to cross the picket-line to the legions of fans dragging Drew Barrymore for scabbing, the public mood is providing the political will for real action:

https://www.motherjones.com/media/2023/09/drew-barrymores-newest-role-scab/

The issues of corruption, worker rights and market concentration can't – and shouldn't – be teased apart. They're three facets of the same fight – the fight against oligarchy. Rarely do those issues come together more clearly than in the delicious petard-hoisting of Dave Clark, formerly the archvillain of Amazon, and now the victim of its bullying.

As Maureen Tkacik writes for The American Prospect, Clark had a long and storied career as Amazon's most vicious and unassuming ghoul, a sweatervested, Diet-Coke-swilling normie whose mild manner disguised a vicious streak a mile wide:

https://prospect.org/power/2023-09-14-catch-us-if-you-can-dave-clark-amazon/

Clark earned his nickname, "The Sniper," as a Kentucky warehouse supervisor; the name came from his habit of "lurking in the shadows [and] scoping out slackers he could fire." Clark created Amazon Flex, the "gig work" version of Amazon delivery drivers where randos in private vehicles were sent out to delivery parcels. Clark also oversaw tens of millions of dollars in wage-theft from those workers.

We have Clark to thank for the Amazon drivers who had to shit in bags and piss in bottles to make quota. Clark was behind the illegal union-busting tactics used against employees in the Bessamer, Alabama warehouse. We have Clark to thank for the Amazon chat app that banned users from posting the words "restroom," "slave labor," "plantation," and "union":

https://pluralistic.net/2022/04/05/doubleplusrelentless/#quackspeak

But Clark doesn't work for Amazon anymore. After losing a power-struggle to succeed Jeff Bezos – the job went to "longtime rival" Andy Jassy – he quit and went to work for Flexport, a logistics company that promised to provide sellers that used non-Amazon services with shipping. Flexport did a deal with Shopify, becoming its "sole official logistics partner."

But then Shopify did another logistics deal – with Amazon. Clark was ordered to tender his resignation or face immediate dismissal.

How did all this happen? Well, there are two theories. The first is that Shopify teamed up with Amazon to stab Flexport in the back, then purged all the ex-Amazonians from the Flexport upper ranks. The other is that Clark was a double-agent, who worked with Amazon to sabotage Flexport, and was caught and fired.

But either way, this is a huge win for Amazon, a monopolist who is in the FTC's crosshairs thanks to the anti-corporate vibe-shift that has consumed the nation and the world. As the sole major employer for this kind of logistics, Amazon is a de facto labor regulator, deciding who can work in the sector. The FTC's enforcement action isn't just about monopoly – it's about labor.

Now, Clark is a rich, powerful white dude, not the sort of person who needs a lot of federal help to protect his labor rights. When liberals called the shot in the progressive coalition, they scolded leftists not to speak of class, but rather to focus on identity – to be intersectionalists.

That was a trick. There's no incompatibility between caring about class and caring about gender, race and sexual orientation. Those fast food workers who are about to get a 30% wage-hike in California? Overwhelmingly Black or brown, overwhelmingly female.

The liberal version of intersectionalism observes a world run by 150 rich white men and resolves to replace half of them with women, queers and people of color. The leftist version seeks to abolish the system altogether. The leftist version of intersectionalism cares about bias and discrimination not just because of how it makes people feel, but because of how it makes them live. It cares about wages, housing, vacations, child care – the things you can't get because of your identity.

The fight for social justice is a fight for worker justice. Eminently guillotineable monsters like Tim "Avocado Toast" Gurner advocate for increasing unemployment by "40-50%" – but Gurner is just saying what other bosses are thinking:

https://jacobin.com/2023/09/tim-gurner-capitalists-neoliberalism-unemployment-precarity

Garner is 100% right when he says: "There’s been a systematic change where employees feel the employer is extremely lucky to have them, as opposed to the other way around."

And then he says this: "So it’s a dynamic that has to change. We’ve got to kill that attitude, and that has to come through hurt in the economy."

Garner knows that the vibes are upstream of the change. The capitalist dream starts with killing our imagination, to make us believe that "there is no alternative." If we can dream bigger than "better representation among oligarchs" when we might someday dream of no oligarchs. That's what he fears the most.

Watch the video of Garner. Look past the dollar-store Gordon Gecko styling. That piece of shit is terrified.

And he should be.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/14/prop-22-never-again/#norms-code-laws-markets

EFF Awards, San Francisco, September 14

Retiring the US debt would retire the US dollar

THIS WEDNESDAY (October 23) at 7PM, I'll be in DECATUR, GEORGIA, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

One of the most consequential series of investigative journalism of this decade was the Propublica series that Jesse Eisinger helmed, in which Eisinger and colleagues analyzed a trove of leaked IRS tax returns for the richest people in America:

https://www.propublica.org/series/the-secret-irs-files

The Secret IRS Files revealed the fact that many of America's oligarchs pay no tax at all. Some of them even get subsidies intended for poor families, like Jeff Bezos, whose tax affairs are so scammy that he was able to claim to be among the working poor and receive a federal Child Tax Credit, a $4,000 gift from the American public to one of the richest men who ever lived:

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

As important as the numbers revealed by the Secret IRS Files were, I found the explanations even more interesting. The 99.9999% of us who never make contact with the secretive elite wealth management and tax cheating industry know, in the abstract, that there's something scammy going on in those esoteric cults of wealth accumulation, but we're pretty vague on the details. When I pondered the "tax loopholes" that the rich were exploiting, I pictured, you know, long lists of equations salted with Greek symbols, completely beyond my ken.

But when Propublica's series laid these secret tactics out, I learned that they were incredibly stupid ruses, tricks so thin that the only way they could possibly fool the IRS is if the IRS just didn't give a shit (and they truly didn't – after decades of cuts and attacks, the IRS was far more likely to audit a family earning less than $30k/year than a billionaire).

This has become a somewhat familiar experience. If you read the Panama Papers, the Paradise Papers, Luxleaks, Swissleaks, or any of the other spectacular leaks from the oligarch-industrial complex, you'll have seen the same thing: the rich employ the most tissue-thin ruses, and the tax authorities gobble them up. It's like the tax collectors don't want to fight with these ultrawealthy monsters whose net worth is larger than most nations, and merely require some excuse to allow them to cheat, anything they can scribble in the box explaining why they are worth billions and paying little, or nothing, or even entitled to free public money from programs intended to lift hungry children out of poverty.

It was this experience that fueled my interest in forensic accounting, which led to my bestselling techno-crime-thriller series starring the two-fisted, scambusting forensic accountant Martin Hench, who made his debut in 2022's Red Team Blues:

https://us.macmillan.com/books/9781250865847/red-team-blues

The double outrage of finding out how badly the powerful are ripping off the rest of us, and how stupid and transparent their accounting tricks are, is at the center of Chokepoint Capitalism, the book about how tech and entertainment companies steal from creative workers (and how to stop them) that Rebecca Giblin and I co-authored, which also came out in 2022:

https://chokepointcapitalism.com/

Now that I've written four novels and a nonfiction book about finance scams, I think I can safely call myself a oligarch ripoff hobbyist. I find this stuff endlessly fascinating, enraging, and, most importantly, energizing. So naturally, when PJ Vogt devoted two episodes of his excellent Search Engine podcast to the subject last week, I gobbled them up:

https://www.searchengine.show/listen/search-engine-1/why-is-it-so-hard-to-tax-billionaires-part-1

I love the way Vogt unpacks complex subjects. Maybe you've had the experience of following a commentator and admiring their knowledge of subjects you're unfamiliar with, only have them cover something you're an expert in and find them making a bunch of errors (this is basically the experience of using an LLM, which can give you authoritative seeming answers when the subject is one you're unfamiliar with, but which reveals itself to be a Bullshit Machine as soon as you ask it about something whose lore you know backwards and forwards).

Well, Vogt has covered many subjects that I am an expert in, and I had the opposite experience, finding that even when he covers my own specialist topics, I still learn something. I don't always agree with him, but always find those disagreements productive in that they make me clarify my own interests. (Full disclosure: I was one of Vogt's experts on his previous podcast, Reply All, talking about the inkjet printerization of everything:)

https://gimletmedia.com/shows/reply-all/brho54

Vogt's series on taxing billionaires was no exception. His interview subjects (including Eisinger) were very good, and he got into a lot of great detail on the leaker himself, Charles Littlejohn, who plead guilty and was sentenced to five years:

https://jacobin.com/2023/10/charles-littlejohn-irs-whistleblower-pro-publica-tax-evasion-prosecution

Vogt also delved into the history of the federal income tax, how it was sold to the American public, and a rather hilarious story of Republican Congressional gamesmanship that backfired spectacularly. I'd never encountered this stuff before and boy was it interesting.

But then Vogt got into the nature of taxation, and its relationship to the federal debt, another subject I've written about extensively, and that's where one of those productive disagreements emerged. Yesterday, I set out to write him a brief note unpacking this objection and ended up writing a giant essay (sorry, PJ!), and this morning I found myself still thinking about it. So I thought, why not clean up the email a little and publish it here?

As much as I enjoyed these episodes, I took serious exception to one – fairly important! – aspect of your analysis: the relationship of taxes to the national debt.

There's two ways of approaching this question, which I think of as akin to classical vs quantum physics. In the orthodox, classical telling, the government taxes us to pay for programs. This is crudely true at 10,000 feet and as a rule of thumb, it's fine in many cases. But on the ground – at the quantum level, in this analogy – the opposite is actually going on.

There is only one source of US dollars: the US Treasury (you can try and make your own dollars, but they'll put you in prison for a long-ass time if they catch you.).

If dollars can only originate with the US government, then it follows that:

a) The US government doesn't need our taxes to get US dollars (for the same reason Apple doesn't need us to redeem our iTunes cards to get more iTunes gift codes);

b) All the dollars in circulation start with spending by the US government (taxes can't be paid until dollars are first spent by their issuer, the US government); and

c) That spending must happen before anyone has been taxed, because the way dollars enter circulation is through spending.

You've probably heard people say, "Government spending isn't like household spending." That is obviously true: households are currency users while governments are currency issuers.

But the implications of this are very interesting.

First, the total dollars in circulation are:

a) All the dollars the government has ever spent into existence funding programs, transferring to the states, and paying its own employees, minus

b) All the dollars that the government has taxed away from us, and subsequently annihilated.

(Because governments spend money into existence and tax money out of existence.)

The net of dollars the government spends in a given year minus the dollars the government taxes out of existence that year is called "the national deficit." The total of all those national deficits is called "the national debt." All the dollars in circulation today are the result of this national debt. If the US government didn't have a debt, there would be no dollars in circulation.

The only way to eliminate the national debt is to tax every dollar in circulation out of existence. Because the national debt is "all the dollars the government has ever spent," minus "all the dollars the government has ever taxed." In accounting terms, "The US deficit is the public's credit."

When billionaires like Warren Buffet tell Jesse Eisinger that he doesn't pay tax because "he thinks his money is better spent on charitable works rather than contributing to an insignificant reduction of the deficit," he is, at best, technically wrong about why we tax, and at worst, he's telling a self-serving lie. The US government doesn't need to eliminate its debt. Doing so would be catastrophic. "Retiring the US debt" is the same thing as "retiring the US dollar."

So if the USG isn't taxing to retire its debts, why does it tax? Because when the USG – or any other currency issuer – creates a token, that token is, on its face, useless. If I offered to sell you some "Corycoins," you would quite rightly say that Corycoins have no value and thus you don't need any of them.

For a token to be liquid – for it to be redeemable for valuable things, like labor, goods and services – there needs to be something that someone desires that can be purchased with that token. Remember when Disney issued "Disney dollars" that you could only spend at Disney theme parks? They traded more or less at face value, even outside of Disney parks, because everyone knew someone who was planning a Disney vacation and could make use of those Disney tokens.

But if you go down to a local carny and play skeeball and win a fistful of tickets, you'll find it hard to trade those with anyone outside of the skeeball counter, especially once you leave the carny. There's two reasons for this:

1) The things you can get at the skeeball counter are pretty crappy so most people don't desire them; and ' 2) Most people aren't planning on visiting the carny, so there's no way for them to redeem the skeeball tickets even if they want the stuff behind the counter (this is also why it's hard to sell your Iranian rials if you bring them back to the US – there's not much you can buy in Iran, and even someone you wanted to buy something there, it's really hard for US citizens to get to Iran).

But when a sovereign currency issuer – one with the power of the law behind it – demands a tax denominated in its own currency, they create demand for that token. Everyone desires USD because almost everyone in the USA has to pay taxes in USD to the government every year, or they will go to prison. That fact is why there is such a liquid market for USD. Far more people want USD to pay their taxes than will ever want Disney dollars to spend on Dole Whips, and even if you are hoping to buy a Dole Whip in Fantasyland, that desire is far less important to you than your desire not to go to prison for dodging your taxes.

Even if you're not paying taxes, you know someone who is. The underlying liquidity of the USD is inextricably tied to taxation, and that's the first reason we tax. By issuing a token – the USD – and then laying on a tax that can only be paid in that token (you cannot pay federal income tax in anything except USD – not crypto, not euros, not rials – only USD), the US government creates demand for that token.

And because the US government is the only source of dollars, the US government can purchase anything that is within its sovereign territory. Anything denominated in US dollars is available to the US government: the labor of every US-residing person, the land and resources in US territory, and the goods produced within the US borders. The US doesn't need to tax us to buy these things (remember, it makes new money by typing numbers into a spreadsheet at the Federal Reserve). But it does tax us, and if the taxes it levies don't equal the spending it's making, it also sells us T-bills to make up the shortfall.

So the US government kinda acts like classical physics are true, that is, like it is a household and thus a currency user, and not a currency issuer. If it spends more than it taxes, it "borrows" (issues T-bills) to make up the difference. Why does it do this? To fight inflation.

The US government has no monetary constraints, it can make as many dollars as it cares to (by typing numbers into a spreadsheet). But the US government is fiscally constrained, because it can only buy things that are denominated in US dollars (this is why it's such a big deal that global oil is priced in USD – it means the US government can buy oil from anywhere, not only the USA, just by typing numbers into a spreadsheet).

The supply of dollars is infinite, but the supply of labor and goods denominated in US dollars is finite, and, what's more, the people inside the USA expect to use that labor and goods for their own needs. If the US government issues so many dollars that it can outbid every private construction company for the labor of electricians, bricklayers, crane drivers, etc, and puts them all to work building federal buildings, there will be no private construction.

Indeed, every time the US government bids against the private sector for anything – labor, resources, land, finished goods – the price of that thing goes up. That's one way to get inflation (and it's why inflation hawks are so horny for slashing government spending – to get government bidders out of the auction for goods, services and labor).

But while the supply of goods for sale in US dollars is finite, it's not fixed. If the US government takes away some of the private sector's productive capacity in order to build interstates, train skilled professionals, treat sick people so they can go to work (or at least not burden their working-age relations), etc, then the supply of goods and services denominated in USD goes up, and that makes more fiscal space, meaning the government and the private sector can both consume more of those goods and services and still not bid against one another, thus creating no inflationary pressure.

Thus, taxes create liquidity for US dollars, but they do something else that's really important: they reduce the spending power of the private sector. If the US only ever spent money into existence and never taxed it out of existence, that would create incredible inflation, because the supply of dollars would go up and up and up, while the supply of goods and services you could buy with dollars would grow much more slowly, because the US government wouldn't have the looming threat of taxes with which to coerce us into doing the work to build highways, care for the sick, or teach people how to be doctors, engineers, etc.

Taxes coercively reduce the purchasing power of the private sector (they're a stick). T-bills do the same thing, but voluntarily (they the carrot).

A T-bill is a bargain offered by the US government: "Voluntarily park your money instead of spending it. That will create fiscal space for us to buy things without bidding against you, because it removes your money from circulation temporarily. That means we, the US government, can buy more stuff and use it to increase the amount of goods and services you can buy with your money when the bond matures, while keeping the supply of dollars and the supply of dollar-denominated stuff in rough equilibrium."

So a bond isn't a debt – it's more like a savings account. When you move money from your checking to your savings, you reduce its liquidity, meaning the bank can treat it as a reserve without worrying quite so much about you spending it. In exchange, the bank gives you some interest, as a carrot.

I know, I know, this is a big-ass wall of text. Congrats if you made it this far! But here's the upshot. We should tax billionaires, because it will reduce their economic power and thus their political power.

But we absolutely don't need to tax billionaires to have nice things. For example: the US government could hire every single unemployed person without creating inflationary pressure on wages, because inflation only happens when the US government tries to buy something that the private sector is also trying to buy, bidding up the price. To be "unemployed" is to have labor that the private sector isn't trying to buy. They're synonyms. By definition, the feds could put every unemployed person to work (say, training one another to be teachers, construction workers, etc – and then going out and taking care of the sick, addressing the housing crisis, etc etc) without buying any labor that the private sector is also trying to buy.

What's even more true than this is that our taxes are not going to reduce the national debt. That guest you had who said, "Even if we tax billionaires, we will never pay off the national debt,"" was 100% right, because the national debt equals all the money in circulation.

Which is why that guest was also very, very wrong when she said, "We will have to tax normal people too in order to pay off the debt." We don't have to pay off the debt. We shouldn't pay off the debt. We can't pay off the debt. Paying off the debt is another way of saying "eliminating the dollar."

Taxation isn't a way for the government to pay for things. Taxation is a way to create demand for US dollars, to convince people to sell goods and services to the US government, and to constrain private sector spending, which creates fiscal space for the US government to buy goods and services without bidding up their prices.

And in a "classical physics" sense, all of the preceding is kinda a way of saying, "Taxes pay for government spending." As a rough approximation, you can think of taxes like this and generally not get into trouble.

But when you start to make policy – when you contemplate when, whether, and how much to tax billionaires – you leave behind the crude, high-level approximation and descend into the nitty-gritty world of things as they are, and you need to jettison the convenience of the easy-to-grasp approximation.

If you're interested in learning more about this, you can tune into this TED Talk by Stephanie Kelton, formerly formerly advisor to the Senate Budget Committee chair, now back teaching and researching econ at University of Missouri at Kansas City:

https://www.ted.com/talks/stephanie_kelton_the_big_myth_of_government_deficits?subtitle=en

Stephanie has written a great book about this, The Deficit Myth:

https://pluralistic.net/2020/05/14/everybody-poops/#deficit-myth

There's a really good feature length doc about it too, called "Finding the Money":

https://findingmoneyfilm.com/

If you'd like to read more of my own work on this, here's a column I wrote about the nature of currency in light of Web3, crypto, etc:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/21/we-can-have-nice-things/#public-funds-not-taxpayer-dollars

The fact that homelessness is controversial tells you everything you need to know about conservatives.

"...I mean the wages of a DECENT LIVING"

every now and again i think "surely it can't be that weird for a child to sort things, it has to be something every child does"

and then i remember that my mother finally had an allistic child after two autistic kids in a row and was baffled and annoyed to find out she couldn't just keep him occupied by sticking a box of unsorted buttons in front of him and let him sort them

like my mother thought, exactly like i do sometimes, that surely every child must just sit there and sort whatever is in front of them but no, actually, most of my non autistic peers didn't do this and thought i was a fucking weirdo for doing it

anyway i still struggle to believe that most people don't find deep enjoyment in sitting there and arbitrarily sorting shit. what do they even do if they need to do data entry? do they just suffer? weirdos.

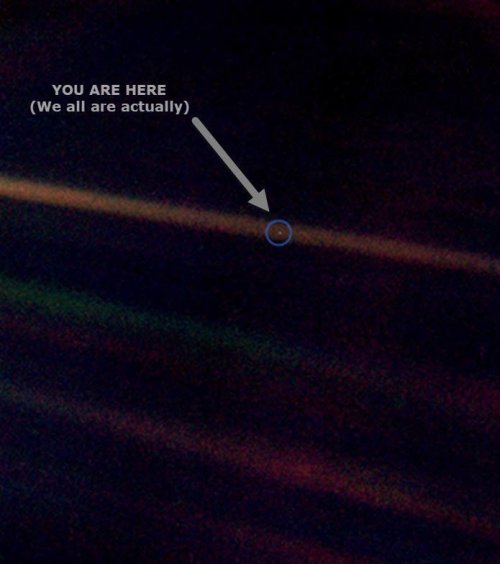

cancel your plans we’re thinking about the pale blue dot voyager pic tonight

very emphatic button emoji

•

Two kilometers down in the deep sea, out of reach of sunlight, lives a siphonophore called Erenna (no second name). It is a pale, gelatinous, delicate animal, a continuous swimmer, and a patient hunter. This thing catches fish using a cluster of lures on its tentacles that flicker back and forth, glowing bioluminescent red. It was the first evidence of luring behavior among the siphonophores.

This is all rather weird though: Erenna itself has no eyes, no light sensing organs at all. And we really thought those fish couldn’t even detect red light. What do they see in each other, these entangled creatures, each doing its best to live, moving silently forward? What signals are they passing in the cold dark?

•

-

paperrocketship liked this · 1 month ago

paperrocketship liked this · 1 month ago -

martin-711 liked this · 2 months ago

martin-711 liked this · 2 months ago -

rffssss liked this · 2 months ago

rffssss liked this · 2 months ago -

tatrrbear liked this · 3 months ago

tatrrbear liked this · 3 months ago -

shadyhorsedragon liked this · 4 months ago

shadyhorsedragon liked this · 4 months ago -

shontal17 liked this · 4 months ago

shontal17 liked this · 4 months ago -

kaiyves-backup liked this · 4 months ago

kaiyves-backup liked this · 4 months ago -

iamaweretoad liked this · 4 months ago

iamaweretoad liked this · 4 months ago -

bewareofdragon reblogged this · 4 months ago

bewareofdragon reblogged this · 4 months ago -

bamboulabrador reblogged this · 5 months ago

bamboulabrador reblogged this · 5 months ago -

exiledpeeker liked this · 7 months ago

exiledpeeker liked this · 7 months ago -

once-a-cub liked this · 7 months ago

once-a-cub liked this · 7 months ago -

medvidevojta liked this · 7 months ago

medvidevojta liked this · 7 months ago -

ephemeralwasteland-blog liked this · 7 months ago

ephemeralwasteland-blog liked this · 7 months ago -

worldlydesiresblog reblogged this · 7 months ago

worldlydesiresblog reblogged this · 7 months ago -

nesquikboy reblogged this · 7 months ago

nesquikboy reblogged this · 7 months ago -

captain-senorx56-universe-blog liked this · 7 months ago

captain-senorx56-universe-blog liked this · 7 months ago -

impossiblycrookedbear liked this · 7 months ago

impossiblycrookedbear liked this · 7 months ago -

tzackt reblogged this · 7 months ago

tzackt reblogged this · 7 months ago -

tzackt liked this · 7 months ago

tzackt liked this · 7 months ago -

starykorab liked this · 7 months ago

starykorab liked this · 7 months ago -

1000sassa1000 liked this · 7 months ago

1000sassa1000 liked this · 7 months ago -

unoeil liked this · 7 months ago

unoeil liked this · 7 months ago -

amimpage liked this · 7 months ago

amimpage liked this · 7 months ago -

luvfur2 liked this · 7 months ago

luvfur2 liked this · 7 months ago -

imatardyfreakngeek liked this · 7 months ago

imatardyfreakngeek liked this · 7 months ago -

johnthestitcher reblogged this · 7 months ago

johnthestitcher reblogged this · 7 months ago -

johnthestitcher liked this · 7 months ago

johnthestitcher liked this · 7 months ago -

josephtailor reblogged this · 7 months ago

josephtailor reblogged this · 7 months ago -

magicaltimewithme liked this · 7 months ago

magicaltimewithme liked this · 7 months ago -

antonio-teixeira liked this · 7 months ago

antonio-teixeira liked this · 7 months ago -

kormo1976 reblogged this · 7 months ago

kormo1976 reblogged this · 7 months ago -

isbbc liked this · 8 months ago

isbbc liked this · 8 months ago -

chibruhman1963 liked this · 8 months ago

chibruhman1963 liked this · 8 months ago -

10inchblktopmaster reblogged this · 8 months ago

10inchblktopmaster reblogged this · 8 months ago -

bewareofdragon liked this · 8 months ago

bewareofdragon liked this · 8 months ago -

harvestar reblogged this · 8 months ago

harvestar reblogged this · 8 months ago -

classysoulcalzonecowboy liked this · 8 months ago

classysoulcalzonecowboy liked this · 8 months ago -

jessystardust liked this · 8 months ago

jessystardust liked this · 8 months ago -

kwa56-blog liked this · 8 months ago

kwa56-blog liked this · 8 months ago -

zanesfield liked this · 8 months ago

zanesfield liked this · 8 months ago -

tebanos liked this · 8 months ago

tebanos liked this · 8 months ago

General interest @culturesinglarityGay shit and lots of dicks @demon-core-incidentDeep Space Nine relevance @temba-his-arms-wideHorny men's tailoring @captaindadsmenshosiery Pfp courtesy of @anonymous-leemur

207 posts